Resources mentioned in this series:

Quantifying your contribution to the workforce.

It’s not uncommon that a victim of medical negligence will experience difficulties in trying to return to work in any capacity, let alone the same job.

The strain of an injury, or the mental trauma inflicted, can often cause the victim to lose wages, now, and into the future.

The past and future economic loss head of damage aims to protect the victim from a loss of earnings. It bridges the gap between what they used to earn, what they earn now, and what they will earn 20 years into the future.

Simply put, future economic loss covers a person's reduced income or lost opportunities.

More specifically, it can cover things like:

These are the types of things not accounted for in most government and private insurance

schemes.

Schemes like the NDIS or Private Accident Insurance.

These schemes will pay the immediate out-of- pocket expenses, but not pay for loss of earnings.

The law will, as much as reasonably possible, try to put the injured person back into the position they most likely would’ve been in before the accident, which includes considering their future potential.

And just how you calculate these future losses can be a complicated exercise.

See, if you asked yourself 10, 15, 25 years ago where you’d be today, you’d probably have no idea.

But that’s precisely what this head of damage is asking you to do – predict every wage-earning movement from the date of the incident until the expected time of retirement.

It might seem impossible. But in just 15 minutes you will be able to do it.

Below we’re going to step you through the same process a lawyer would take to help you calculate your economic loss - considering your future first, and then the past.

One download between you and your key to compensation...

Want to fast track the process with our free interactive workbook?

Quantifying your Future Economic Loss

For the majority of claimants, future economic loss will be the most significant head of damage they receive. So whilst this section might seem confusing or complicated, it’s not that difficult if you follow a template.

All heads of damage after this will be an easier step towards the quantum threshold of $150,000.

Future Economic Loss

EXAMPLE: SASHA

Sasha was a mother of one who experienced surgical negligence.

After Sasha became a victim of surgical negligence, she found it impossible to maintain her hours at work. She had to halve her hours – from 40 to 20 – which, naturally, halved her income from $850 to $425.

Her doctor told her she would never be able to return to the 40 hours per week in her current job. Below, we will use this example to step you through the first section.

STEP 1: REDUCTION IN INCOME

STEP 2: years until retirement

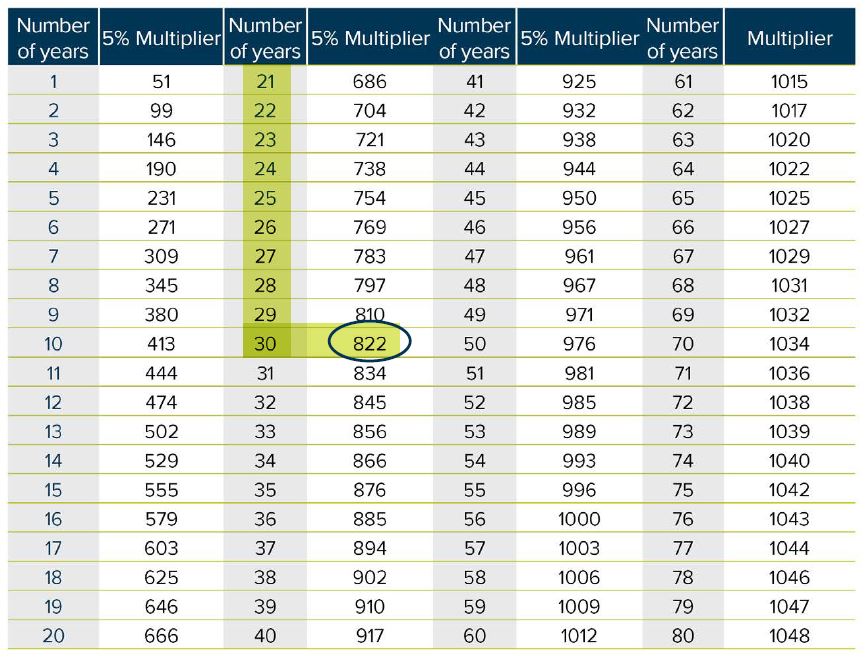

STEP 3: 5% Multiplier

STEP 4: future loss of earnings

STEP 5: GLOBAL BUFFER

STEP 6: THE FINAL CALCULATION

You should note this number on your own Schedule of Damages table to keep track of where you’re at.

A schedule of damages is the document a lawyer gives to insurers that summarises the losses their client has experienced.

Future Loss of Superannuation

We’ve covered your losses up until retirement, but what about losses after retirement?

Expenses don’t just stop once you retire - if anything, they can get worse.

That’s why (in compensation), superannuation is accounted for, and quite easy to work out. To calculate future losses, we need to look at the future superannuation rate.

As of 2019, the rate of superannuation that an employer has to pay is 9.5% of your wages.

By 2025, this rate will increase to 12%.

For this reason, we will work off the 12% for calculating your future loss of superannuation.

STEP 1: FUTURE LOSS OF SUPERANNUATION

Now that you have that, you can add it to your schedule of damages.

One download between you and your key to compensation...

Want to fast track the process with our free interactive workbook?

Quantifying your Past Economic Loss

Now that we’ve covered what you are predicted to lose in the future, let’s look at what you’ve already lost since the accident.

We call this period, between the accident and now, the ‘past’.

‘Past’ refers to the period between the medical negligence occurring and the current date.

For this reason, calculating your past economic losses will be much easier than the previous

section - predicting the future losses.

STEP 1: MISSED HOURS AT WORK

STEP 2: LOST INCOME

STEP 3: ADDITIONS FOR LOST BENEFITS

EXAMPLE: SASHA

In Sasha’s example, we know that she has been losing $450 a week (half of her income). Let’s say that’s been going on for 12 months now (52 weeks), and that every month she would earn a $100 bonus for meeting her targets.

We would determine her past economic loss by calculating:

$24,600

You can now add this number to your schedule of damages.

Interest on Past Economic Loss

We can’t forget that there was a potential to earn interest on the past economic loss.

The law in QLD takes this into account, allowing you to be compensated for it. To work out what amount you should be compensated for, follow these steps:

STEP 1: RBA INTEREST RATE

STEP 2: HALF IT

STEP 3: FINAL CALCULATION

EXAMPLE: SASHA

For Sasha, the current Reserve Bank of Australia interest rate is 0.75 and her past economic loss was $24,600. Therefor:

$95.25

You can now add this number to your schedule of damages.

Superannuation on Past Economic Loss

The final step in this head of damage is calculating your past loss of superannuation, much like we calculated your future loss.

To do this, we apply the same formula. However, we will use the current standard rate of 9.5% instead of the future 12%.

You should replace the 9.5% with the rate your employer has been paying if it’s higher than this base rate.STEP 1: PAST LOSS OF SUPERANNUATION

You can now add this number to your schedule of damages.

One download between you and your key to compensation...

Want to fast track the process with our free interactive workbook?

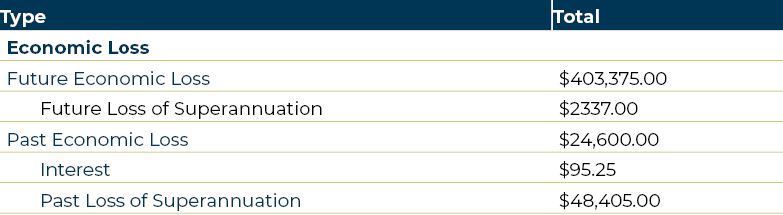

Putting it all together.

Now you can add this to your schedule of damages.

It’s recommended, at this point, to add up your damages so far to see if you’ve reached the

$150,000 quantum threshold.

Below is Sasha’s example.

By doing this, you can check if you can surpass the remainder of this workbook and start working out how you’re going to hold your doctor accountable.

If you haven’t passed the threshold yet, don’t worry. There are three more heads of damage to cover.

Let’s jump into our second head of damage - gratuitous care.

Next article: What is gratuitous care and how is it calculated?

Get Social

Share

We'd love if you joined our Facebook Community. We post things that we are passionate about or that interest medical negligence victims or issues in the systems that are supposed to support their recovery, as well as more unrestricted content like this.

Get in touch.

PHONE

07 3231 0604

[email protected]

ADDRESS

345 Queen St, Brisbane City, QLD, 4000